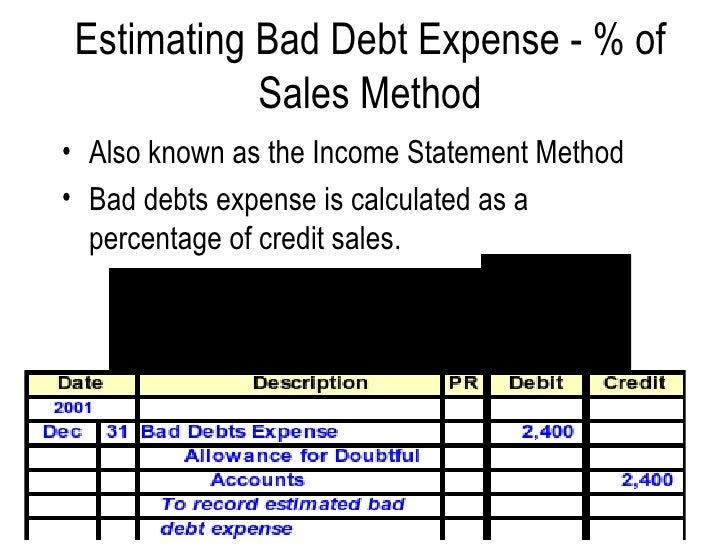

For example, a company's checking account (an asset) has a credit balance if the account is overdrawn. Occasionally, an account does not have a normal balance. You may find the following chart helpful as a reference. To determine the correct entry, identify the accounts affected by a transaction, which category each account falls into, and whether the transaction increases or decreases the account's balance. Liability, revenue, and owner's capital accounts normally have credit balances.

Therefore, asset, expense, and owner's drawing accounts normally have debit balances. An account's assigned normal balance is on the side where increases go because the increases in any account are usually greater than the decreases.

Debits (abbreviated Dr.) always go on the left side of the T, and credits (abbreviated Cr.) always go on the right.Īccountants record increases in asset, expense, and owner's drawing accounts on the debit side, and they record increases in liability, revenue, and owner's capital accounts on the credit side. The account title and account number appear above the T. The simplest account structure is shaped like the letter T.

Expense debit credit update#

The Work Sheet When Closing Entries Update Inventory.Closing Entries for a Merchandising Company.Inventory Adjustments on the Work Sheet.

Financial Statements for a Merchandising Company.The Cost of Goods Available for Sale and the Cost of Goods Sold.Net Purchases and the Cost of Goods Purchased.Generally Accepted Accounting Principles.

0 kommentar(er)

0 kommentar(er)